It’s 2025, and you’re filling your prescription for metformin, lisinopril, or levothyroxine-medicines you’ve been taking for years. The price at the counter? $12. Not $120. Not even $30. Just $12. Sounds good, right? But if you’re on a fixed income, juggling rent, groceries, and utilities, $12 a month adds up. And if you’re not on Medicare, or you make just enough to disqualify you from Medicaid, you might be stuck paying that $12 with no help at all.

Generic drugs are supposed to be the answer to high drug costs. They’re chemically identical to brand-name pills, approved by the FDA, and cost 80-85% less. In 2023, generics made up 92% of all prescriptions in the U.S., but only 23% of total drug spending. That sounds like a win. But for millions of people, even those low prices are too high. And unlike brand-name drugs, which often come with manufacturer copay cards that can cut your cost to $0, generic medications rarely have those kinds of programs. Why? Because generic makers don’t make enough profit to offer them.

How Generic Copay Help Actually Works

There’s no big pharmaceutical company handing out free coupons for generic blood pressure pills. Instead, help comes from three places: government programs, pharmacy discount cards, and nonprofit organizations. Each has rules, limits, and hidden traps.

If you’re on Medicare, your best shot is the Extra Help program (also called the Low-Income Subsidy). In 2025, if you qualify, you pay exactly $4.90 for every generic prescription and $12.15 for brand-name drugs. No deductible. No coverage gap. Just $4.90. To qualify, your income must be under $22,590 for a single person or $30,660 for a couple in 2025. You automatically qualify if you get Medicaid, SSI, or a Medicare Savings Program.

But here’s the catch: if you make $23,000 a year, you’re out of luck. No Extra Help. No manufacturer coupons. And your insurance might still charge you $10-$15 per generic. That’s what millions of Americans face-the assistance gap. You’re not poor enough for government aid, but you’re not rich enough to absorb $150 a year in out-of-pocket costs for essential meds.

Pharmacy Discount Programs: Your Free Coupon Hack

Walmart’s $4 generics list. Kroger’s $15 program. SingleCare, GoodRx, Blink Health. These aren’t insurance. They’re cash discount cards you can use even if you have coverage. You don’t need to apply. You don’t need to prove income. Just show the coupon at the pharmacy counter.

Walmart covers about 150 generic drugs-things like atorvastatin, metformin, levothyroxine, amlodipine. For $4, you get a 30-day supply. For $10, you get a 90-day supply. That’s cheaper than most insurance copays. But here’s what most people don’t know: you can’t use these discounts with your insurance. If you try to use both, the pharmacy will charge you the higher price. So if your insurance copay is $12, and the discount is $4, you have to choose: use your insurance (pay $12) or use the coupon (pay $4). Always pick the coupon.

A 2024 American Pharmacists Association study found that 62% of patients don’t even ask for these discounts. They assume their insurance is the best deal. It’s not. Always check the cash price first.

Nonprofit Assistance: The Hard Way, But Worth It

Organizations like the PAN Foundation, NeedyMeds, and Patient Access Network offer grants to help cover copays. But they’re not easy to get. PAN only helps with 72 diseases-and only 17 of those are conditions treated mostly with generics, like high blood pressure, diabetes, or thyroid disorders. You need to be under 400% of the federal poverty level ($62,600 for a family of four). You need a doctor’s note. You need proof of income. And it takes 3 weeks to process.

NeedyMeds approved 78% of applicants in 2023 who made under 250% of the poverty line ($37,150 for one person). But only 12% of those between 250% and 400% got help. That’s the gap again. People earning $40,000 a year, working two jobs, still can’t afford their meds. And no one’s helping them.

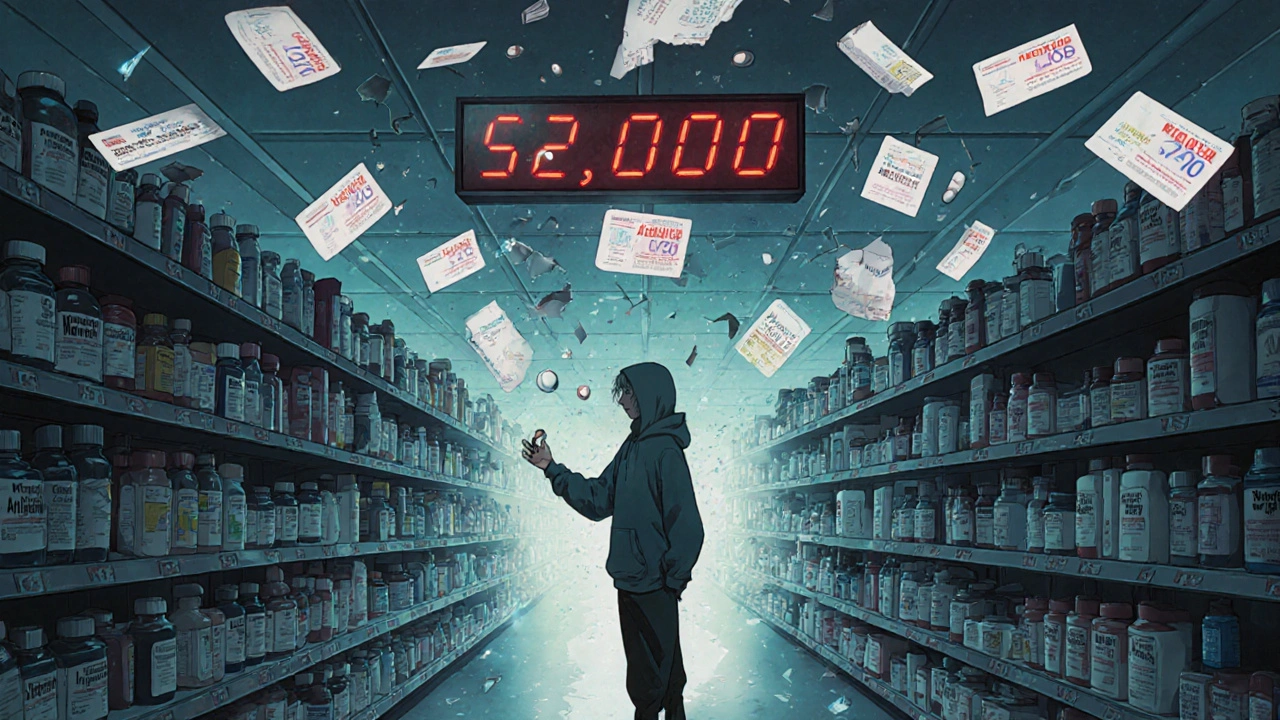

The Big Change Coming in 2025

Starting January 1, 2025, the Inflation Reduction Act changes everything for Medicare Part D users. There’s now a hard cap: you pay no more than $2,000 out-of-pocket for all your drugs in a year. That’s down from $8,300 in 2024. For people taking multiple generics, this is huge. If you take five generics at $10 each, that’s $600 a year. You’ll hit the cap in less than 4 months. After that, your meds are free for the rest of the year.

Extra Help recipients get even more: no deductible, no coverage gap, and a $2 monthly cap on insulin. Generic insulin, too. That’s a game-changer.

But here’s the downside: if you’re not on Medicare, none of this applies. And if you’re on Medicare but don’t qualify for Extra Help, you still pay full copays until you hit that $2,000 cap. For someone taking 10 generics at $12 each, that’s $1,440 a year. You’re close-but you still have to pay it all before the cap kicks in.

Who Gets Left Behind

The system works great for two groups: people with very low income (they get Extra Help) and people with high drug costs (they hit the $2,000 cap fast). But it fails the middle.

Think of someone earning $2,100 a month ($25,200 a year). They have commercial insurance. Their three generics cost $32 a month-$16 for levothyroxine, $10 for metformin, $6 for lisinopril. They make $300 over the Medicaid limit. They don’t qualify for Extra Help. No manufacturer coupons exist for these drugs. The pharmacy discount card gets them down to $4 per pill. But they don’t know about it. Or they’re too busy to look. So they pay $32. Every month. For years.

That’s $384 a year. It’s not a lot, but it’s money they can’t spare. And if they skip a dose to save money? That’s when things get dangerous. A 2023 study in the Annals of Internal Medicine found that 38% of people who couldn’t afford their generics skipped doses or cut pills in half. That’s not frugality. That’s a public health crisis.

What You Can Do Right Now

Step 1: Ask your pharmacist for the cash price. Not the insurance price. The cash price. Always.

Step 2: If the cash price is lower than your copay, use it. Don’t use your insurance. You’re not saving money-you’re wasting it.

Step 3: Go to NeedyMeds.org or SingleCare.com. Search your drug. See if there’s a discount card. Print it. Use it.

Step 4: If you’re on Medicare, apply for Extra Help. Even if you think you make too much. The rules are tricky. You might qualify. Call 1-800-MEDICARE. Or visit your local SHIP (State Health Insurance Assistance Program) office. They help for free.

Step 5: Apply for multiple programs at once. Successful applicants use an average of 2.3 assistance sources. Don’t wait for one to approve you. Apply to three. If one works, great. If not, you’ve got backups.

Step 6: Tell your doctor. If you’re skipping doses because of cost, they can help. They might switch you to a different generic that’s cheaper. Or they might write a letter to your insurer to get an exception.

Final Reality Check

Generic drugs aren’t magic. They’re cheaper, yes. But they’re not free. And the system doesn’t care if you’re just above the poverty line. You’re not invisible-you’re just not on the radar.

That’s changing in 2025. The $2,000 cap will help millions. But until then, you have to fight for yourself. Don’t assume your insurance has your back. Don’t assume the pharmacy knows the best price. Don’t assume no help exists.

Help exists. You just have to ask for it. And sometimes, you have to demand it.

Can I use a pharmacy discount card with my insurance for generics?

No. You have to choose one or the other. Pharmacy discount cards like GoodRx or Walmart’s $4 list are cash prices. Insurance copays are separate. If you use your insurance, you pay the copay. If you use the discount card, you pay the cash price. Always compare both and pick the lower one.

Why don’t generic drug companies offer copay cards like brand-name companies do?

Generic manufacturers make very thin profits-often just pennies per pill. Brand-name companies charge hundreds of dollars per pill and use copay cards to keep patients on their drugs. Generic makers can’t afford to give away money without raising prices, which would defeat the whole purpose. Their business model is volume, not subsidies.

I’m on Medicare but don’t qualify for Extra Help. What can I do?

Start by checking your Part D plan’s formulary. Some plans have lower copays for certain generics. Switch plans during Open Enrollment (Oct 15-Dec 7) if you find a better one. Also, use pharmacy discount cards. And apply for Extra Help anyway-even if you think you’re too rich. The income limits are higher than most people think, and you might qualify for partial help.

Does the $2,000 out-of-pocket cap in 2025 apply to all my drugs or just generics?

It applies to all drugs covered under your Medicare Part D plan-both brand-name and generic. But because generics are cheaper, you’ll need more refills to hit the cap. That means you’ll reach the $2,000 limit faster if you’re taking expensive brand-name drugs. For people on mostly generics, the cap still helps-it just takes longer to get there.

What if I can’t afford even the discounted price for my generic?

Talk to your doctor. They may be able to prescribe a different generic that’s cheaper. Or they can help you apply for a nonprofit assistance program like PAN Foundation. You can also call 211-a free service that connects people to local health and financial aid resources. Don’t skip your meds. There are options, even if they take work to find.

Are all generics covered by pharmacy discount programs?

No. Most programs cover the most common ones-like metformin, lisinopril, atorvastatin, levothyroxine. But if you’re on a less common generic, like a specific thyroid medication or a rare antibiotic, it might not be on the list. Always check the specific pharmacy’s website or call ahead. Some independent pharmacies offer their own discounts, even if big chains don’t.

Next Steps

If you’re paying more than $10 a month for a generic drug, you’re likely overpaying. Start with your pharmacist. Then check NeedyMeds. Then call 1-800-MEDICARE. Don’t wait for someone to help you. Help yourself. The system won’t fix itself-but you can fix your part of it.