By 2030, nearly one in every three pills taken worldwide will be a generic version of a drug once sold under a brand name. This isn’t just a trend-it’s a global shift in how medicine is paid for, produced, and prescribed. The generic drug market, long seen as a cost-cutting afterthought, is now the backbone of affordable healthcare. And it’s growing faster than most people realize.

Why Generic Drugs Are Suddenly Everywhere

Generic drugs aren’t cheap knockoffs. They’re exact copies of brand-name medicines-same active ingredient, same dose, same effect. The only difference? They cost 80% to 90% less. That’s because they don’t need to repeat the billion-dollar clinical trials the original drug went through. Once a patent expires, any manufacturer can apply to make it. In the U.S., that process is handled by the FDA through the Abbreviated New Drug Application (ANDA). In Europe, it’s the EMA. In India and China, it’s even faster.Between 2025 and 2030, over $220 billion in annual sales from top brand-name drugs will lose patent protection. That’s not a small number. That’s the entire annual budget of a mid-sized country. Drugs like ustekinumab (Stelara), vedolizumab (Entyvio), and liraglutide (Victoza) are all set to go generic. These are treatments for psoriasis, Crohn’s disease, and diabetes-conditions that affect millions. When generics hit, prices drop overnight. A monthly shot of Stelara might go from $5,000 to $500. That’s life-changing for patients and health systems alike.

Where the Growth Is: Asia Leads, Europe Stabilizes, U.S. Explodes

Not all regions are growing at the same pace. Asia-Pacific is the fastest-moving market. India alone supplies 20% of the world’s generic drugs and 60% of its vaccines. Chinese manufacturers, thanks to aggressive volume-based procurement systems, have become price setters for the entire globe. If a drug gets bid down to $0.10 per tablet in China, that becomes the new global benchmark.In Europe, Germany and the UK are the leaders. Their public health systems actively push doctors to prescribe generics. In the UK, over 85% of prescriptions are for generics. That’s not because patients prefer them-it’s because the NHS requires it. The EU has also streamlined approval for biosimilars, which are generic versions of complex biologic drugs. These used to take 8-10 years to develop. Now, with faster pathways, companies can bring them to market in under 5 years.

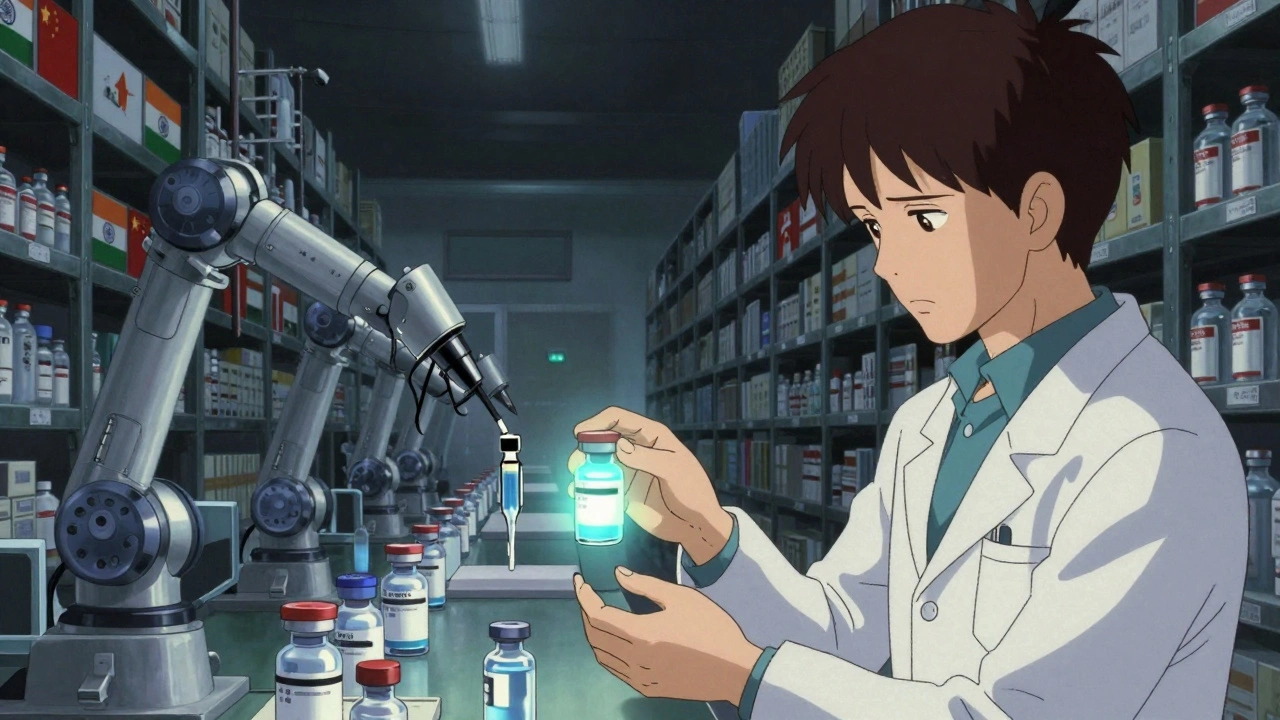

The U.S. market is different. It’s not the biggest in volume, but it’s the most valuable. Americans spend more per person on drugs than any other country. And with over $100 billion in at-risk sales expected by 2028, the U.S. will see the biggest generic influx in history. Companies like Teva, Viatris, and Amneal are already preparing. They’re investing in automation, robotic packaging, and AI-driven supply chains to handle the surge.

Biosimilars: The New Frontier

The biggest shift isn’t just in simple pills. It’s in biologics-complex drugs made from living cells. These include treatments for cancer, rheumatoid arthritis, and multiple sclerosis. Until recently, these were too complicated to copy. But now, biosimilars are here.By 2029, the biosimilars segment alone could be worth $25 billion. That’s because drugs like Humira, which brought in $20 billion a year at its peak, are losing exclusivity. Humira’s first biosimilar hit the U.S. market in 2023. Within 18 months, it captured over 30% of the market. That’s unheard of in pharma.

What makes biosimilars different? They’re not identical to the original. They’re “similar enough.” That means manufacturers need advanced labs, strict quality controls, and real-world data proving they work the same. This isn’t a race to the bottom-it’s a race to the top. The companies that get it right will dominate. The ones that cut corners will fail.

Therapeutic Areas Driving Demand

Not all generics are created equal. Some categories are growing faster than others because of disease trends.- Oncology: Cancer drugs are the most expensive category. By 2030, over $300 billion will be spent globally on cancer treatments. Generics and biosimilars will make up a growing share.

- Diabetes: With over 500 million people living with diabetes worldwide, drugs like metformin and insulin are in constant demand. Insulin generics are now approved in the U.S. and will hit prices under $25 per vial by 2027.

- Cardiovascular: High blood pressure and cholesterol drugs are among the most prescribed. Almost all are generic now. But new versions-like fixed-dose combinations-are emerging, combining two drugs in one pill to improve adherence.

- Metabolic diseases: Drugs like Ozempic and Mounjaro are blockbuster brands today. But their patents expire in the late 2020s. When they do, the market will explode. We’re talking about $100 billion in potential generic sales.

These aren’t niche markets. They’re the core of modern healthcare. And generics are the only way to make them sustainable.

Who’s Winning and Who’s Losing

The market is becoming a two-tier system. On one side: big players with global supply chains, regulatory expertise, and manufacturing scale. On the other: smaller companies trying to compete on price alone.India’s Sun Pharma, Dr. Reddy’s, and Cipla are scaling fast. They’ve built massive facilities in Gujarat and Andhra Pradesh. They’re not just making pills-they’re making supply chains that can deliver to 120 countries. China’s Jiangsu Hengrui and Shanghai Pharmaceuticals are doing the same, using state-backed financing to undercut everyone.

In the U.S., Viatris and Teva are consolidating. They’ve merged, bought up competitors, and are now focused on high-margin complex generics. Meanwhile, smaller U.S. firms are struggling. Many can’t afford the $10 million it takes to get FDA approval for a single new generic. Some are being bought out. Others are disappearing.

Europe’s big generics makers-like Sandoz (Novartis) and Mylan-are shifting focus to biosimilars. They know the future isn’t in simple tablets. It’s in injectables, infusions, and biologics.

Challenges Ahead: Price Pressure and Complexity

Growth doesn’t mean easy profits. The biggest threat to the generic industry isn’t regulation-it’s pricing.China’s tender system forces manufacturers to bid against each other. The lowest bid wins. That’s great for patients. But it’s brutal for companies. Margins are often under 10%. Some are operating at break-even. That’s why many manufacturers are moving production out of China-to India, Mexico, or Eastern Europe.

Another challenge? Complexity. The next wave of generics won’t be aspirin or metformin. They’ll be inhalers with precise dosing, long-acting injectables, and transdermal patches. These require advanced technology. Not every factory can make them. That’s creating a barrier to entry-but also a chance for specialists.

Technology is helping. Robotic packaging, AI for quality control, and blockchain for supply chain tracking are becoming standard. Companies that invest in these now will survive. Those that don’t won’t make it past 2030.

What This Means for You

If you’re a patient: expect lower drug costs. More options. Better access. Insulin, cancer drugs, and heart medications will become affordable for millions who couldn’t afford them before.If you’re a healthcare provider: you’ll have more tools to manage budgets. Prescribing generics isn’t just ethical-it’s economic. It frees up money for other care.

If you’re an investor: the sector is volatile, but the long-term trend is clear. Biosimilars and complex generics are the future. Look for companies with strong R&D, global manufacturing, and regulatory expertise-not just low prices.

If you’re a policymaker: the lesson is simple. Support generics. Streamline approvals. Don’t let patent litigation block access. The savings are real. The impact is massive.

The Bottom Line

The generic drug market isn’t just growing. It’s transforming healthcare. From $400 billion in 2024 to over $700 billion by 2030, it’s one of the most predictable and powerful economic forces in medicine. The patents are expiring. The demand is rising. The technology is ready. The only question left is: who will be ready to meet it?Are generic drugs as safe as brand-name drugs?

Yes. Generic drugs must meet the same strict standards as brand-name drugs. In the U.S., the FDA requires them to have the same active ingredient, strength, dosage form, and route of administration. They must also prove they’re absorbed into the body at the same rate and extent. Thousands of studies and real-world use confirm they work the same way. The only differences are in inactive ingredients-like fillers or dyes-which don’t affect how the drug works.

Why are generic drugs cheaper?

Generic manufacturers don’t need to repeat expensive clinical trials. They rely on the original drug’s safety and effectiveness data. Their costs are mostly in manufacturing and regulatory approval. Because multiple companies can make the same drug, competition drives prices down. A single generic version might cost 30% less than the brand. With five or six competitors, prices often drop to 80-90% lower.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs, like pills made from chemicals. Biosimilars are copies of large, complex biologic drugs made from living cells-like antibodies or proteins. Because biologics are so complex, biosimilars aren’t identical, but they’re “highly similar” with no clinically meaningful differences. Biosimilars take longer and cost more to develop, but they’re the next wave of affordable biologics, especially for cancer and autoimmune diseases.

Which countries are leading in generic drug production?

India is the world’s largest supplier of generic drugs by volume, providing 20% of global supply and 60% of vaccines. China is the second-largest, especially in active pharmaceutical ingredients (APIs). The U.S. and Europe produce high-value complex generics and biosimilars. Germany and the UK lead in adoption, while India and China lead in manufacturing scale.

Will generic drugs replace all brand-name drugs?

No-and they shouldn’t. Brand-name drugs still play a critical role in innovation. New drugs for rare diseases, personalized medicine, and gene therapies will always need brand-name development. But for established treatments-like blood pressure pills, diabetes meds, and antibiotics-generics are the standard. The future isn’t about replacing brands. It’s about using generics to make healthcare affordable for everyone.