When a patient in Germany, Poland, or Spain picks up a generic version of a branded drug, they’re not just getting a cheaper alternative-they’re benefiting from one of the most complex regulatory systems in the world. The European Union’s approach to generic medicines isn’t a single rulebook. It’s a patchwork of four different approval paths, each with its own timelines, costs, and hidden hurdles. And as of 2025, everything is changing.

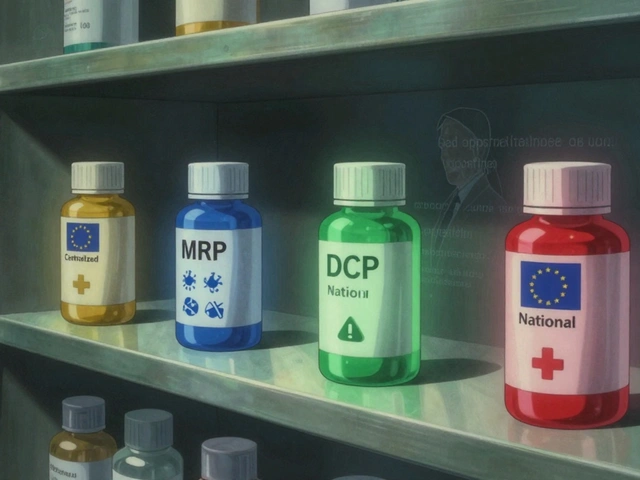

Four Ways to Get a Generic Drug Approved in the EU

There’s no one-size-fits-all path to market in Europe. Generic manufacturers must choose from four approval routes, and each one shapes how fast, how cheaply, and how widely their drug can be sold.

The Centralized Procedure is the fastest way to launch across all 27 EU countries, plus Iceland, Liechtenstein, and Norway. A single application goes to the European Medicines Agency (EMA). If approved, the drug gets a marketing authorization valid everywhere. The catch? It costs between €1.6 million and €2.2 million total-€425,000 in fees, plus up to €1.8 million in consulting and study costs. Only companies targeting high-value generics with projected sales over €250 million annually make this worth it. Sandoz used this route for its version of Novartis’s Cosentyx and launched across the entire EU in Q2 2025-11 months faster than any other path would have allowed.

The Mutual Recognition Procedure (MRP) is the most popular, used in 42% of cases. A company gets approval in one country-the Reference Member State-then asks others to recognize it. Sounds simple, right? Not quite. Each country can raise objections. Germany might demand extra stability data. France might want pediatric formulation details. Even if the EMA says the drug is fine, national authorities can delay approval for months. Teva’s generic rosuvastatin was approved in Germany in January 2023, but didn’t reach the Dutch and Belgian markets until September-8.2 months later-because of pricing negotiations.

The Decentralized Procedure (DCP) lets companies apply to multiple countries at once. No prior approval needed. But coordination is a nightmare. The Reference Member State leads the review, but every other country gets a say. A 2024 GMDP Academy study found 37% of DCP applications face delays longer than six months, mostly because Eastern European regulators interpret quality standards differently. One company reported a 247-day average timeline-47 days longer than the official 210-day window.

The National Procedure is the slowest and most limited. Submit to one country only. Approval only applies there. It’s rarely used-just 5% of applications-but some companies still pick it to target high-reimbursement markets like France. Accord Healthcare took 197 days to get a national approval in France, but only 142 days to get the same drug approved in five countries via MRP. Why bother? Sometimes, the local reimbursement system pays better, even if the process is slower.

What Makes a Generic ‘Generic’? The Science Behind Approval

Before any of these procedures even start, the drug has to prove it’s identical to the original. Not ‘similar.’ Not ‘close enough.’ Identical.

The EMA requires three things: same active ingredient, same dosage form, and proven bioequivalence. That last part isn’t a formality-it’s a full clinical study. The generic must deliver the same amount of drug into the bloodstream at the same rate as the brand. The standard? 90% confidence intervals for Cmax (peak concentration) and AUC (total exposure) must fall between 80% and 125% of the original. No exceptions.

But here’s where things get messy. Germany’s BfArM requires extra pharmacodynamic studies for complex generics like inhalers. France demands specific documentation for pediatric use. Italy has stricter impurity limits for older reference products. These aren’t EU-wide rules-they’re national add-ons. A 2025 ABPI survey of 47 generic companies found 68% listed inconsistent national bioequivalence requirements as their biggest headache.

Even the bioequivalence guidelines changed in 2025. The EMA updated its guidance to require more precise testing for drugs with narrow therapeutic windows-like warfarin or levothyroxine. That means longer studies, more participants, and higher costs.

The 2025 Pharma Package: What’s Changing?

For the first time in 20 years, the EU is overhauling its generic drug rules. The reforms, finalized in June 2025, are designed to speed up access, reduce shortages, and level the playing field.

The biggest change? The Bolar exemption got a major boost. Before, generic makers could start negotiating prices and reimbursement only two months before a patent expired. Now? They can start six months earlier. That might not sound like much, but REMAP Consulting’s 2025 model shows it cuts average market entry time by 4.3 months. It also gives payers more leverage. With earlier HTA submissions, competition starts before the generic even hits shelves-driving down launch prices by 12-18%.

Regulatory Data Protection (RDP) is also shrinking. The standard protection period drops from 10 years to 8 years, plus 1 year of market exclusivity. That’s it. Unless the drug meets public health targets-like treating a rare disease or filling a critical shortage-it can’t get the extra 2-year extension. This could accelerate generic entry for 78 high-value biologics currently in development, according to Evaluate Pharma.

But there’s a catch. The new system introduces Transferable Exclusivity Vouchers for companies that develop generics targeting unmet medical needs. If a company hits a €490 million sales threshold, it gets a voucher that can be sold to another company for extra protection on a different drug. Experts like Dr. Sabine Rödl of EGA say this helps small firms, but others worry it’ll favor big players. Mid-sized generics companies might not have the sales volume to qualify.

Who’s Winning? Who’s Getting Left Behind?

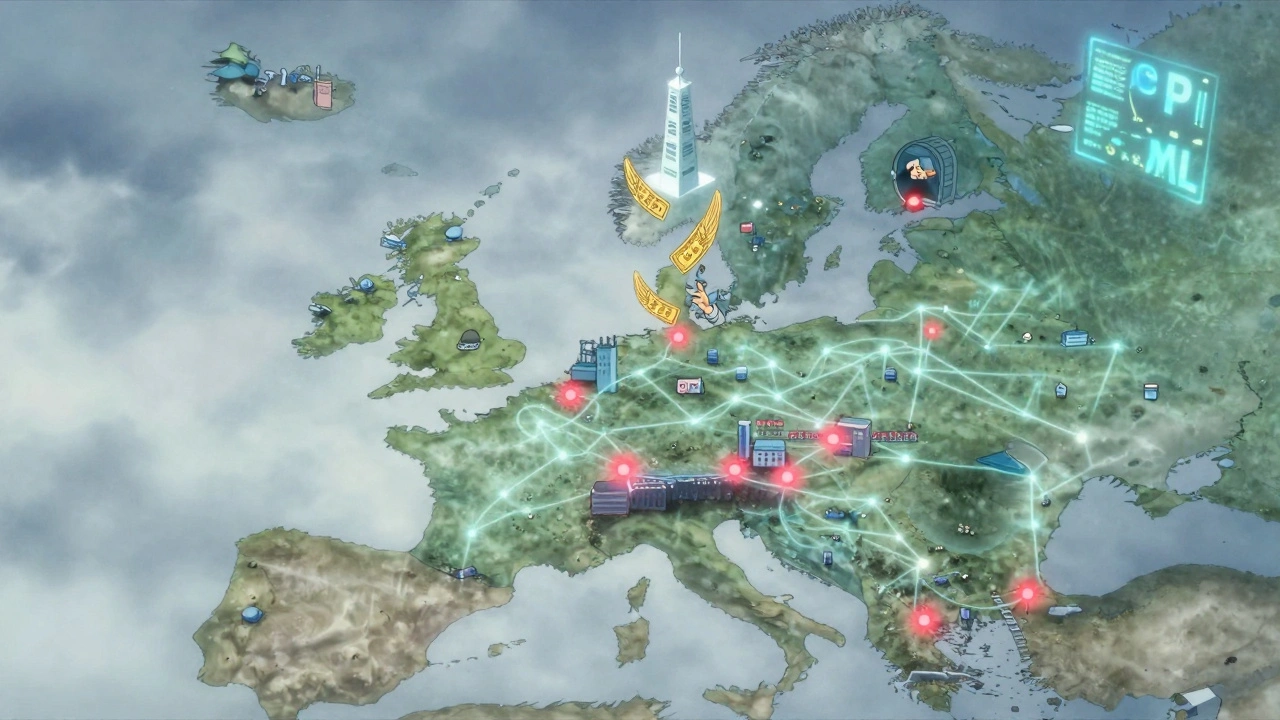

The EU generics market was worth €42.7 billion in 2024, growing 6.2% from the year before. But who’s making the money?

Indian manufacturers captured 38% of all EU generic approvals in 2024-up from 29% in 2020. Their low-cost production and aggressive pricing are reshaping the market. Meanwhile, European firms like Sandoz and Viatris still hold 52% of the market, but they’re doing it differently. They’re not chasing low-margin pills. They’re going after high-value, complex generics-like biosimilars and inhalers-and using the Centralized Procedure to dominate the whole continent at once.

Smaller companies are stuck in the middle. The MRP and DCP are cheaper to start, but the delays cost more in the long run. Mylan (now Viatris) reported that MRP coordination delays added €3.2 million in carrying costs per high-value launch. Accord Healthcare’s regulatory head said the 180-day clock restarts every time a country objects-making supply chain planning impossible.

The new obligation to supply rule requires companies to maintain enough stock to meet demand. If they don’t, they can be fined. That’s good for patients-it could cut medicine shortages by 35% by 2028, according to REMAP Consulting. But it’s another barrier for small players. Stockpiling requires cash, warehouse space, and logistics. Can a startup afford that?

What’s Next? The Real Challenges

The 2025 reforms are just the beginning. By 2026, all product information must be submitted electronically in XML format (ePI). That’s not just a paperwork change-it’s a tech overhaul. Companies need new software, trained staff, and IT infrastructure. White & Case estimates this will cost €180,000-€250,000 per company.

And then there’s the Joint HTA Regulation, which became operational in January 2025. It means the EU will start doing joint health technology assessments for new generics. One evaluation, shared across countries. Sounds efficient. But who controls it? Will bigger countries dominate the process? Will smaller ones lose influence? That’s still unclear.

The biggest threat? Fragmentation. Even with all the harmonization, national authorities still have final say on pricing, reimbursement, and supply. A drug approved by the EMA can still be blocked in a country because the local health ministry says it’s ‘too expensive.’

Meanwhile, the US-EU Framework Agreement, effective September 2025, could change ingredient tariffs. It’s too early to say how much it’ll cost generic makers-but any increase in raw material prices will squeeze margins even tighter.

Bottom Line: Speed, Cost, and Complexity

Europe’s generic market isn’t broken. It’s just incredibly complicated. The 2025 reforms are the most significant shift in decades, and they’re designed to fix what’s broken: long delays, inconsistent rules, and supply shortages.

But they’re not a magic fix. The Centralized Procedure is fast but expensive. The Mutual Recognition Procedure is common but slow. The Decentralized Procedure is flexible but chaotic. And the National Procedure is safe but isolated.

For manufacturers, the key isn’t just knowing the rules-it’s knowing which path fits your product, your budget, and your timeline. For patients, the goal is clear: faster access to affordable medicines. The system is moving in that direction. But it’s still a marathon, not a sprint.